The Background Check

Built for the Trades

ShieldHub is the first background check solution designed to help you meet all your background check requirements for an entire year!

Experience the ShieldHub Difference

Discover why nearly 100,000 independent contractors and vendors have relied on ShieldHub to meet client background check requirements.

ShieldHub Makes it Easy

As an independent contractor, it’s not uncommon to have to purchase multiple background checks a year. ShieldHub eliminates this need by providing a continuously monitored background check that’s valid for an entire year. With the ability to share your ShieldScore with unlimited customer and partners, ShieldHub might be the last background check you’ll ever need to buy.

Frequently Asked Questions

ShieldHub is not a background check or consumer reporting agency but a technology designed to make it easy for independent contractors to meet background check requirements. Additional benefits not found in traditional background checks include:

Portability

With ShieldHub there’s no limit to number of customers you can share your background data with. ShieldID™ allows clients and customers to find your ShieldScore™.

If you make your ShieldID™ searchable on the network, it’s also absolutely free for clients and customers to verify your ShieldID™.

Save Money

Reduce the number of regular background checks you need to purchase annually by leveraging free ShieldID™ sharing and verification with unlimited clients and customers.

Data Protection

Every ShieldHub background check includes a standardized ShieldScore™ that’s designed to measure composite criminal risk. Companies that accept ShieldScore™ in lieu of a traditional background check get the security they need while protecting private and sensitive details found in regular background checks.

Data Sharing & Networking

As customers and clients request your ShieldScore™, they may also add you to their trusted network. Once you are in a client’s network you have complete control as to the data you share about yourself. ShieldPulse™ continuous monitoring enables your clients verify work eligibility 24/7 without you ever needing to purchase anything.

To complete the background check in New York, additional state and local jurisdiction searches are required. These additional searches not only require additional diligence and review, they are include local and jurisdictional fees.

Yes, the ABC# you may be familiar with through Aspen Grove, is now known as ShieldID™.

No. ShieldHub does not accept completed background checks from alternative providers at this time. ClearStar is ShieldHub’s CRA Partner and your background check must be completed through ShieldHub to obtain a ShieldID™ and ShieldScore™.

No. ShieldHub does not include credit as a data element in its background check.

Organizations across many industries—real estate services, home services, inspections, gig platforms, field operations, and more—regularly ask whether a state licensing background check can be used in place of their own contractor-screening requirements. Professionals often assume that because the state ran a background check for licensure, that same check should satisfy a company or client’s onboarding standards. This FAQ explains why that isn’t the case, and why “intended use” matters when relying on background-screening data.

Do licensed professionals usually undergo a background check?

Yes. Many state licensing boards require criminal-history checks through state agencies or the FBI to determine whether an applicant is eligible for licensure and whether they meet standards of public trust.

If the state already ran a background check, why can’t a company just use it?

Because the state’s check and a company’s check serve entirely different purposes. Licensure checks determine whether someone is legally eligible to practice, while contractor onboarding checks determine whether the individual meets a company’s risk, safety, and compliance requirements. These are separate processes governed by different laws.

Are state licensing background checks shareable with private companies?

Generally, no. Criminal-history information collected by a licensing board is treated as confidential under state law. Boards use this information internally and are typically prohibited from releasing it to private entities such as employers, vendor networks, platforms, or clients.

Can the licensed individual obtain a copy to share?

In most cases, they cannot. Licensing boards usually do not release the underlying criminal-history results to the applicant. Because the data isn’t released to them, it cannot be shared with you.

Does holding a valid state license satisfy a company’s background-check requirement?

No. A license confirms only that the person met the state’s eligibility criteria at the time of licensure—not that they have met your organization’s screening or ongoing risk requirements.

Why is “intended use” so important?

Background checks are regulated based on purpose. A report created for one purpose cannot simply be reused for another. A state licensure check is for regulatory eligibility only, while a company-requested check is for safety, risk management, and client assurance. Using a background check outside of its intended purpose may not satisfy lender expectations, platform standards, regulator guidance, or customer requirements.

What is the recommended approach for organizations that onboard independent contractors?

Best practices call for using a recent, purpose-built background check supported by updates or monitoring to maintain ongoing visibility into risk. This ensures the information aligns with your organization’s compliance needs—not the state’s licensing requirements.

How does ShieldHub help?

ShieldHub is built specifically for independent contractor screening and compliance, enabling professionals to maintain secure control over their background-check data while giving organizations a reliable method to maintain safety, trust, and regulatory alignment.

In the United States, background checks and consumer reports are governed by the Fair Credit Reporting Act (FCRA), which strictly controls how consumer data is collected, used, and shared.

Under the FCRA:

- Only individuals or entities with a “permissible purpose” (e.g., employment, tenant screening, personal inquiry) can access consumer reports.

- The subject of the report must provide authorization.

- The consumer reporting agency (CRA) must take “reasonable measures to verify” the identity and legitimacy of the you, the requester.

ShieldHub has partnered with Onfido, an Entrust Company. Onfido is relied on by over 1,200 organizations – including major global banks, fintech leaders, and digital marketplaces. Notable clients include HSBC, Intuit, Fidelity, Coinbase, TD Bank and Uber all of which use Onfido’s technology to securely verify identities and comply with KYC (Know Your Customer) and regulatory requirements.

ID verification is the cornerstone of KYC (Know Your Customer) compliance ensuring that customers are who they claim to be and helping institutions prevent fraud, money laundering, and identity theft from the outset.

Verification Protects Against Identity Theft and Misuse

Imagine someone trying to access your personal records—your Social Security number, your criminal history, even your past addresses—without your knowledge. It happens more often than you think.

ID verification stops bad actors in their tracks. It ensures that only legitimate, authorized individuals can access these sensitive reports. Without this safeguard, personal data could easily fall into the wrong hands—leading to identity theft, discrimination, or worse.

It Adds Transparency and Accountability

Every background check leaves a trail. When your identity is verified, it helps ensure the process is accountable, auditable, and fair. Should a dispute arise, everyone involved can look back and confirm who accessed what, and why.

This transparency doesn’t just protect the person being screened—it also protects you, the requester, by showing that your actions were lawful, ethical, and fully documented.

Can I confirm my identity another way?

Yes, you can download and fill out our Identity Validation Affidavit.

You will be required to get the affidavit notarized. Once notarized, you can email your Affidavit to ShieldHub at compliance@shieldhub.com. Your background check report can be ordered once the ShieldHub has verified your identity.

Please be aware that delays in submitting your Identity Verification Affidavit may delay your background check report.

Tips & Tricks

PLEASE READ BEFORE ORDERING BACKGROUND CHECK(S): You will be required to complete two steps for proper verification. To avoid additional fees, please complete both steps according to the instructions below.

STEP 1

You will be required to provide two (2) photos of your face or “selfies” (one neutral expression and one smiling). When you take the photos, you will need to be in an area with good lighting so the photos will be crisp and not blurry. We highly recommend using a smart phone and not just a device with a camera. Please refer to the examples below on how to properly submit the pictures.

Visit our support center for more ID verification tips & tricks.

STEP 2

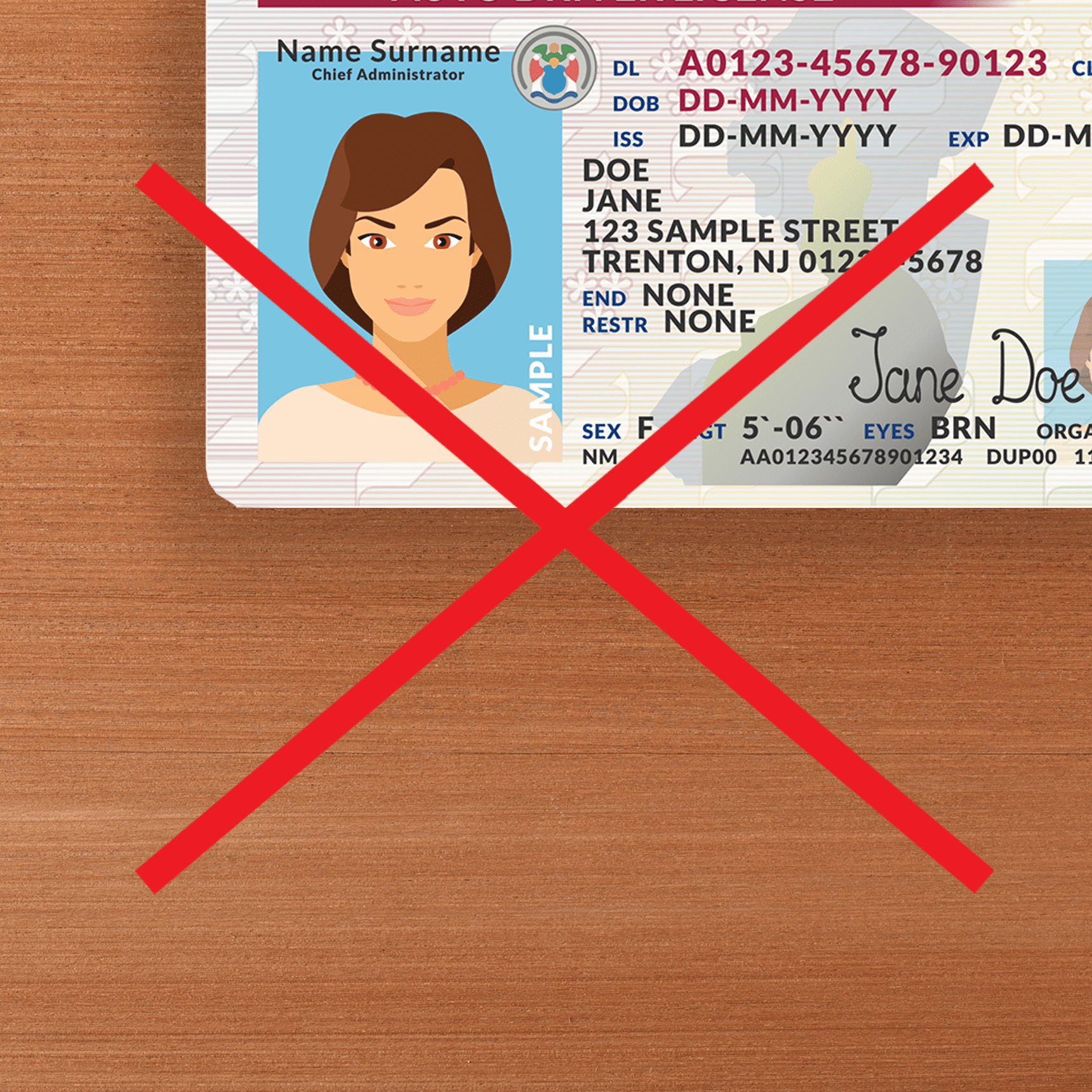

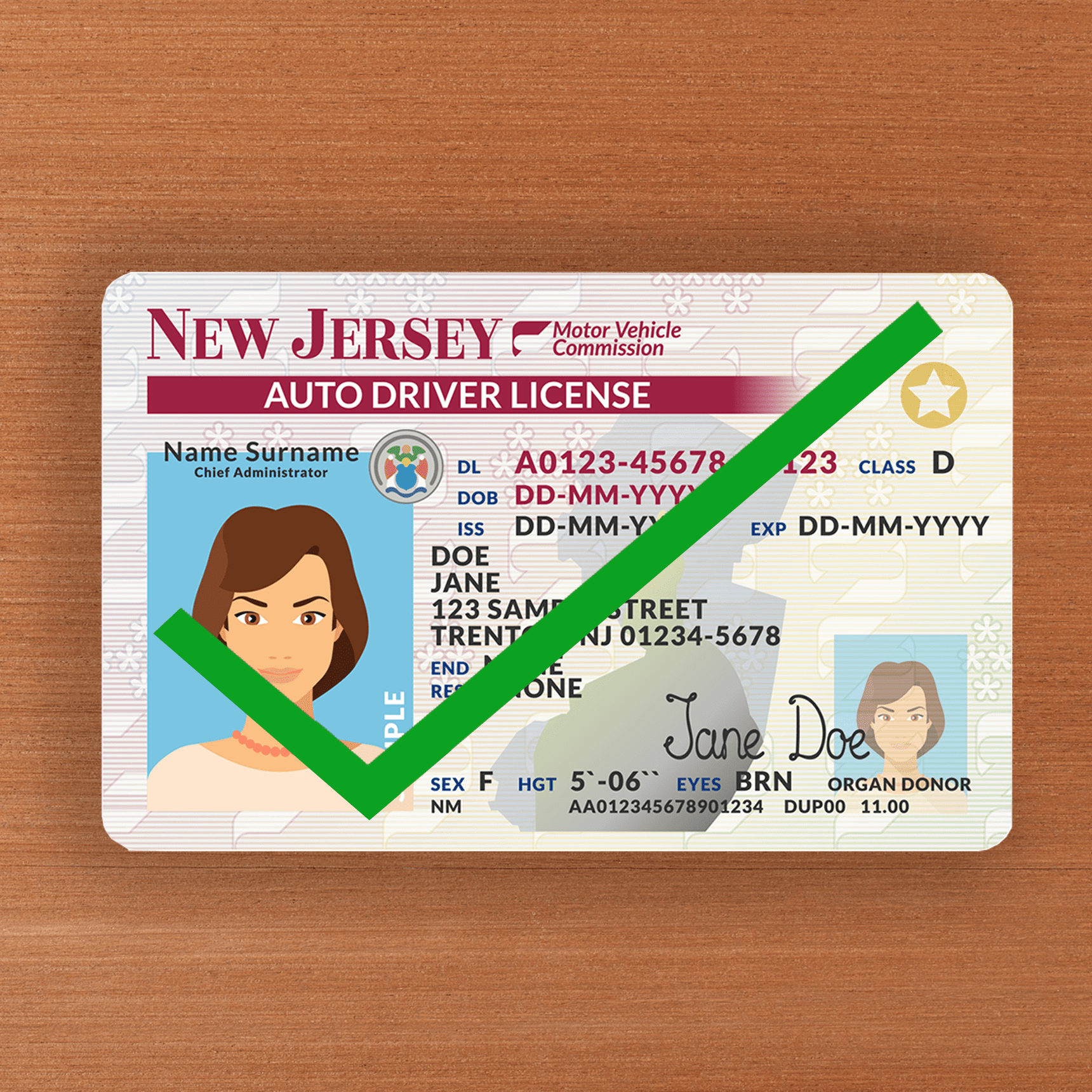

You will be required to provide a picture of your government-issued photo ID. Please refer to the examples below on how to properly submit the picture.